Qualified Leasehold Improvement Property

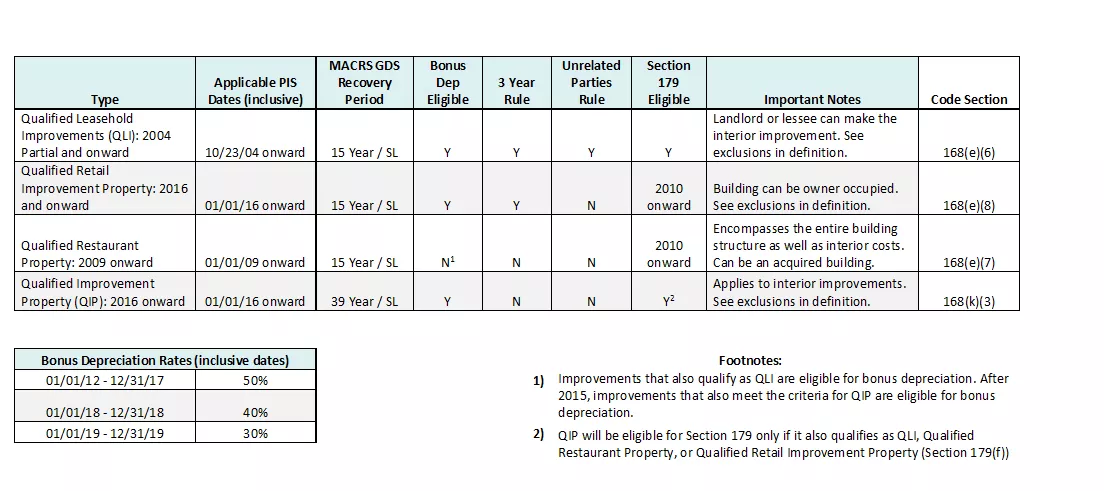

Qualified Leasehold Improvement Property. Qualified Improvement Property (QIP) accelerates significant deductions to enhance cash flow for taxpayers who are improving and/or renovating an existing building. Qualified improvement property is an improvement made by the taxpayer to an interior portion of a nonresidential building if the improvement is placed in service after the building was first placed in service.

Qualified leasehold improvements are tax-deductible changes to the insides of leased, nonresidential property.

Note that repairs related to ordinary "wear-and-tear" are not treated as leasehold improvements.

Suppose a tenant improved a leased office space immediately after moving in at the start of a ten-year lease. The QIP definition is a tax classification of assets that generally includes interior, non-structural improvements to nonresidential buildings placed-in-service after the buildings. Leasehold Improvement can be described as the changes that are made to the leased or rental property in order to ensure that it is best suited for the purposes of the tenant.

Rating: 100% based on 788 ratings. 5 user reviews.

Donald Gearhart

Thank you for reading this blog. If you have any query or suggestion please free leave a comment below.

0 Response to "Qualified Leasehold Improvement Property"

Post a Comment